Fraud Detection System

Overview

The FraudDetection System is a Python-based solution designed to identify and mitigate fraudulent transactions within financial datasets. By leveraging state-of-the-art machine learning algorithms and comprehensive data preprocessing techniques, this system ensures the accurate detection of fraudulent activities.

Key Features

- Data Preprocessing: Robust data preprocessing capabilities, including handling of missing values, encoding of categorical variables, and normalisation of numerical features, to ensure data integrity and model accuracy.

- Machine Learning Models: Integration of multiple machine learning models, including a deep learning model (FraudDetectionModel) and a random forest model (FraudDetectionRFModel), tailored for high-performance fraud detection.

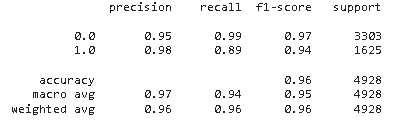

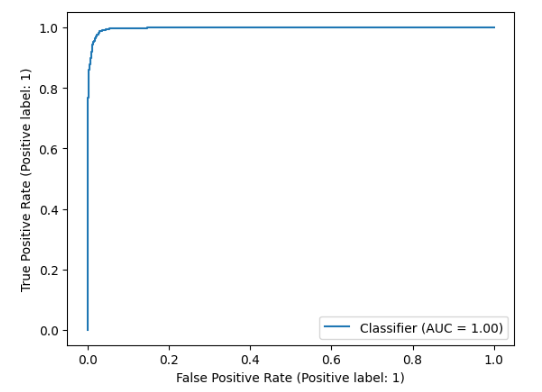

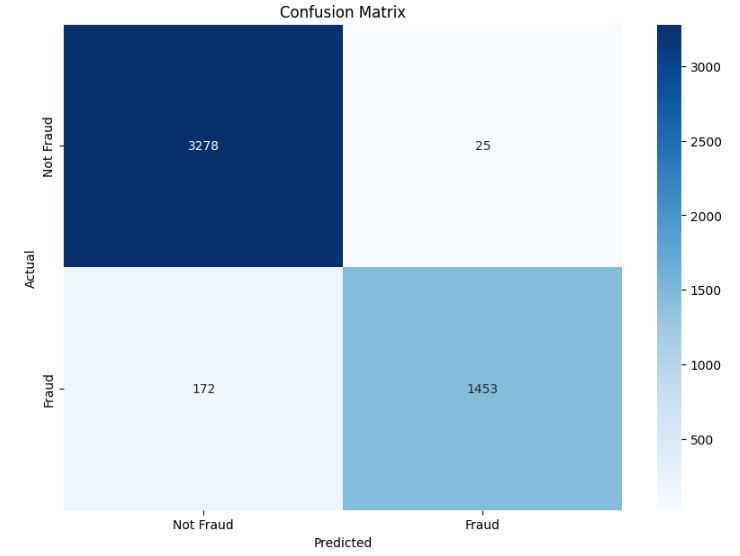

- Model Evaluation: Comprehensive model evaluation metrics, including accuracy, precision, recall, and F1 score, to rigorously assess the effectiveness of each model.

- Model Persistence: Support for saving and loading trained models, enabling seamless deployment and reuse in various operational environments.

System Requirements

- Python

- Pandas for data manipulation and analysis

- Numpy for numerical computations

- Torch for deep learning

- Scikit-Learn for machine learning

- Matplotlib and Seaborn for data visualisation

Usage Instructions

- Data Preparation: Download the relevant dataset (e.g., Fraud.csv) and place it in the designated Fraud_data directory. Utilise the DataPreprocessing module to prepare the data for model training.

- Model Training: Train a deep learning model using the FraudDetectionModel class and the random forest model using the FraudDetectionRFModel class to detect fraudulent transactions.

- Model Evaluation: Apply the ModelEvaluation module to thoroughly assess the performance of each trained model using various metrics.

- Model Persistence: Save the trained models with the ModelSaving module, and load them when required using the ModelLoading module for continued analysis.

Example Use Cases

- Fraud Detection: Employ the system to detect and prevent fraudulent transactions within a financial dataset, safeguarding financial operations.

- Model Comparison: Utilise the system to perform comparative analysis of different machine learning models, optimising the approach to fraud detection tasks.

Model Evaluation

ROC-AUC

Confusion Matrix